I was interviewed on BBC Radio 4 Today programme (listen here from 1:10:16 – 1:24:37 mins), Sky News, Bloomberg (write up here) and Times Radio (a clip here) following the fiscal statement. Some reflections below, and you can read my blog for Politeia on it here. I also spoke on the Policy Exchange Agenda podcast, with my colleagues Ruth Kelly and Conor Macdonald, which can be watch here.

The market reaction in the U.K. is not just a reaction to the mini-Budget, but also to the Bank of England on Thursday and Fed on Wednesday. It is also a continuation of previous trends, a I argued back in February when I said there would be a £ devaluation.

Also as I stated recently: “The new Government needs to be mindful of the febrile state of markets. This reinforces the need to articulate clearly the new policy agenda and to hit the ground running.”

On the currency front, this is largely a strong $ story. This week saw the Bank of Japan intervene to help the yen; in India the rupee weakening through 80 has been a news story since July; the € is weak; and so too is £ versus the $.

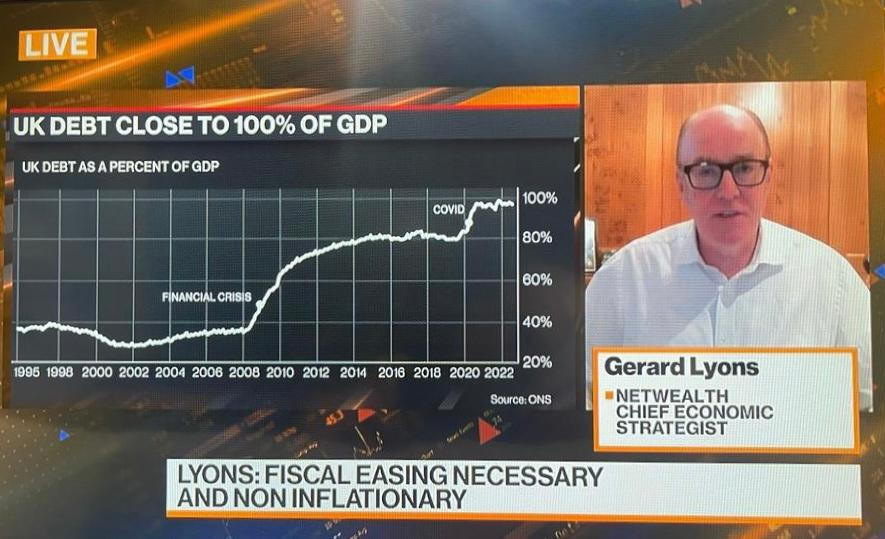

Contrary to what some ill-informed US economists may think, this is not due to Brexit. Moreover, the move to a looser fiscal stance to stabilise the economy now, while ensuring future fiscal discipline, alongside monetary policy focusing on inflation makes sense.

A big challenge is that policy rates are 2.25%, but markets even before today were expecting them to peak at twice this level – markets are often febrile in such an environment of rate hikes – and not helped by the Bank’s self-made credibility gap.

Gilt yields are catching up with the market’s expected outlook for policy rates, plus the increased gilt issuance via the DMO and Thursday’s confirmation from the Bank of England of a further £80bn issuance because of QT and from the latest fiscal boost.

Such a boring and old story to see people calling £ an emerging market currency. We have a strong external investment picture. This is not 1992. The £ is not pegged.

I got the timing of Black Wednesday and subsequent economic recovery spot-on – contrary to the consensus, and on the record. £ is a shock absorber that is very cheap.