CGTN Europe interview – Chinese Premier Li Qiang signals more proactive fiscal policy

https://www.youtube.com/watch?v=jdXlcqrdF6k

Keynote address – China-UK New Era Cooperation Dialogue

It was good to give a keynote at the launch of CCCUK’s report into Chinese firms in the UK. Improved revenue and profitably by Chinese firms, and profits above global average for 1 in 8. The UK and China need to differentiate between strategic and non-strategic in the bilateral relationship. A...

Institute of Fiscal Studies podcast – How important is the OBR forecast?

Great to join the Institute for Fiscal Studies' podcast with Paul Johnson and Andy King to discuss the OBR - how it works, why it's important - and the UK's fiscal position. Separately, this week the third five-yearly external review of the ORB - which I gave evidence to - was published and is a...

BBC Radio 4 Today programme interview – and Netwealth op-ed

Today I was interviewed on BBC Radio 4's Today programme on President Trump's economic agenda. I also wrote about this for Netwealth. In short, Trump's policy can be described as the good, the bad and the uncertain. Listen back to my interview here (20:30-30:50 minutes) and read my Netwealth piece...

Asia House panel – Annual Outlook 2025

It was good to speak at Asia House alongside Mallika Ishwaran (Chief Economist, Shell) and Michael Birshan (Global Partner of Strategy and Corporate Finance Practice, McKinsey) to discuss the Asia House Annual Outlook 2025. Some of my analysis was quoted in China Daily. You can watch my panel...

Global Times interview – China-UK need to have a sensible, resilient relationship

It was good to be interviewed by the Global Times (15th January 2025) on the Chancellor's recent trip to China, and what future UK-China ties should look like. Editor's Note: Facing criticism from opposition parties, UK Chancellor of the Exchequer Rachel Reeves on Tuesday defended her recent visit...

BBC Radio 4 interview – The World Tonight

Good to join The World Tonight, with Grace Blakeley, to discuss the bond market, the Chancellor's options and the Bank of England. List back here from 24:17-32:14 minutes.

China Daily op-ed: Dialogue has put China-UK relations on firmer ground

This op-ed was first published on China Daily - 14th January 2025. The 11th China-UK Economic and Financial Dialogue, which was held in Beijing on Saturday, offered a great opportunity to reset the bilateral relationship and place it on a firmer footing. The two sides agreed to expand cooperation...

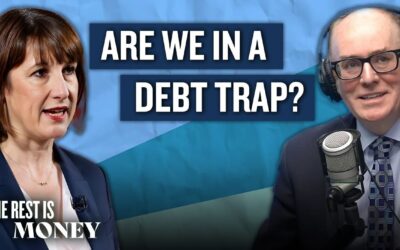

The Rest is Money interview

Good to sit down with Robert Peston and Steph McGovern from ‘The Rest Is Money’ to discuss the UK’s economic outlook, the danger of a debt trap and the Chancellor’s trip to China. Watch it here. https://www.youtube.com/watch?v=KJGpcDOhSOw

Times op-ed: Both China and UK can reap reward from stronger links

This op-ed first appeared in The Times - 06th January 2024 Britain, with one of the world’s largest service sector economies and the second biggest financial centre, has much to gain from a deeper economic relationship with China given its scale. The first Economic and Financial Dialogue between...